SmartNFT Protocol : 26 Months Analysis

The SmartNFT Protocol token $VEE experienced a 387% increase in price and a 2,382% surge in trading volume following strategic partnership by SmartMedia Technologies.

TL;DR

The SmartNFT Protocol (SNP), originally launched by BLOCKv Solutions in October 2018, saw significant growth after being acquired by SmartMedia Technologies (SMT) in October 2022. Key metrics from March 2022 to January 2024 reveal substantial increases in price, volume, and wallets created, but declines in triggers, VEE consumption, and staker rewards. The $VEE price rose by 387%, and traded volume surged by 2,382%, with notable activity peaks in December 2023. Despite some decreases, the protocol's structural adjustments and new partnerships from SMT, indicate potential for sustained value and growth. The upcoming release of new tokenomics and SmartNFT Labs in Q2 2024 is highly anticipated.

Analysis

Although BLOCKv Solutions and the SmartNFT Protocol (SNP) officially launched in October 2018, its real usage began only after SmartMedia Technologies acquired BLOCKv Solutions in October 2022 and initiated substantial marketing campaigns with major brands.

Thanks to the efforts of PaulH (from the BLOCKv Telegram), who has been collecting metrics on the SNP since March 2022, we can conduct a comprehensive analysis.

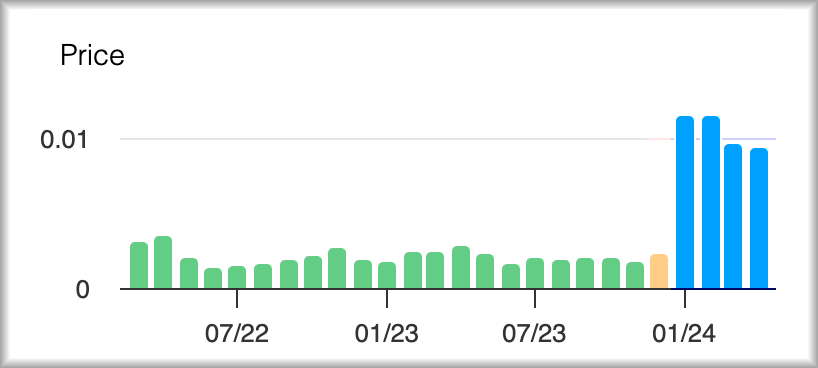

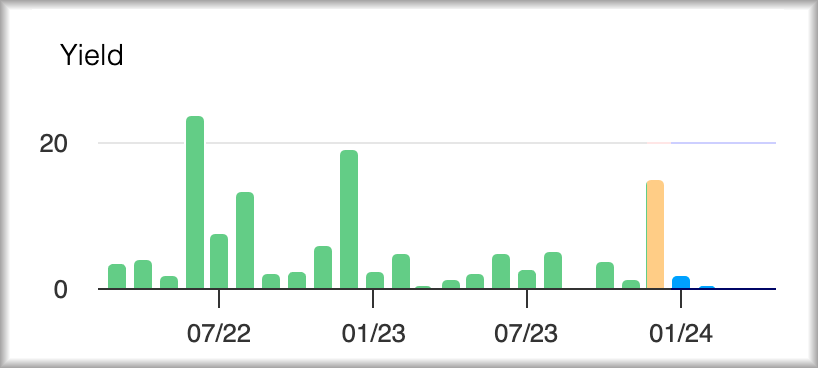

As illustrated in the charts, the data can be divided into two distinct periods:

A) Up to December 2023, during which numerous campaigns were created by SMT (shown in green and orange in the charts).

B) From January 2024 onwards, following the announcement of the partnership between VISA and SMT (shown in blue in the charts)

Note: The orange month is part of period A (green) but shown in a different color because it’s a transitional month between the two periods.

Price

The average price during period A was $0.0022, which increased to an average of $0.0106 in period B, representing a 387% increase.

Volume

The average monthly traded volume in period A was $207,000. This surged to an average of $5.1 million in period B, marking a 2,382% increase. January was the peak month with over $13 million in traded volume.

Holders

The average number of addresses holding the $VEE token during period A was 8,026, which rose to an average of 9,513 in period B, an increase of 18.52%.

Wallets Created

The average monthly number of wallets created during period A was 194,000, increasing to an average of 213,000 in period B, a 9.83% rise. Wallets are created each time a new user registers for one of the marketing campaigns managed by SmartMedia Technologies. To date, 9.7 million wallets have been created by the protocol.

SmartNFTs Created

The average monthly number of SmartNFTs created during period A was 194,000, which increased to an average of 210,000 in period B, an 8.53% rise. To date, 45.6 million SmartNFTs have been created by the protocol.

Triggers

The average monthly number of triggers during period A was 12.1 million, which decreased to an average of 671,000 in period B, a drop of 94.5%. Triggers are special actions performed on SmartNFTs, such as dropping one in augmented reality or sending one to someone else. The significant decline in triggers began in March 2023, well before period B, suggesting a structural evolution within the protocol. To date, 1.07 billion triggers have been handled by the protocol.

VEE Staked

The average monthly staked VEE during period A was 313.2 million, which slightly decreased to 311.2 million in period B, a decrease of 0.62%. Stakers collect 50% of all VEE consumed by the protocol. To date, 8.77% of all VEE are staked.

VEE Consumed

The average monthly consumption of the $VEE token during period A was 4 million, which decreased to 190,000 in period B, a drop of 95.3%. The $0.02 cost to create a SmartNFT is paid in USD but charged in VEE, meaning the VEE amount varies with the token's price. Given the 387% price increase between the two periods, a more accurate metric is the fees paid to the protocol, which will be examined shortly. To date, 324 million VEE have been consumed by the protocol.

Fees

Although fees are paid in VEE, we will analyze them in USD for clarity. The average monthly fees in USD during period A were $7,900, which decreased to $2,000 in period B, a decline of 74.71%. To date, $3.04 million USD has been paid in fees to the protocol.

Rewards

The average monthly VEE rewarded to stakers during period A was 1.48 million, which decreased to 170,000 in period B, a decrease of 88.5%. Stakers receive 50% of the VEE consumed, and as the price increases, fewer VEE are consumed, though each VEE's value is higher. To date, 33.2 million VEE have been rewarded to stakers.

Gains

The average monthly USD value (distributed in VEE) rewarded to stakers during period A was $2,950, which decreased to $1,910 in period B, a decline of 35.2%. For each calculation, we used the VEE price specific to each month, not the current price.

Yield

The average monthly yield during period A was 5.75%, which decreased to 0.68% in period B, a drop of 88.24%. This sharp decline can be attributed to the increase in $VEE price at the end of period A, which reduced the amount of VEE consumed while the staked percentage remained largely the same. Despite the yield drop, Gains only decreased by 35.2%, indicating that stakers are now receiving fewer VEE per VEE staked, but approximately the same USD returns.

P/F Ratio

The Price/Fee Ratio, calculated as the market cap divided by the annualized fees collected by the protocol, indicates the number of years of collected fees needed to match the current market cap of the project—the lower the better. Currently, Solana is at 185, Ethereum at 341, and Bitcoin at 1,904. The average monthly P/F Ratio during period A was 191, which increased to 1,680 in period B, a rise of 779.14% due to the sharp increase in VEE price.

Our Take

December 2023 marked a significant turning point for the SmartNFT Protocol (SNP), with notable achievements including:

The highest recorded VEE price, traded volume, market cap, and wallets created.

The highest number of VEE consumed and distributed to stakers by the protocol since June 2022.

The highest recorded fees paid to the protocol and SmartNFTs created in a month.

A resurgence in trigger activity close to 2022 levels.

The highest recorded percentage of VEE staked at 10.1%.

The highest recorded gains paid to stakers, which appreciated significantly with the next month's price increase.

A yield of 15%.

A P/F ratio of 23, significantly better than Solana, Ethereum, and Bitcoin.

We believe that much of the activity in late 2023 was driven by protocol testing and evaluation by Smart Media Technologies' (SMT) new partner, announced in January. The reduced activity in early 2024 can likely be attributed to the preparation of marketing campaigns planned for later in the year.

Using December 2023's protocol usage as a benchmark for sustainable activity and considering the current VEE price, we are confident that the protocol will deliver substantial value to token holders as adoption increases and stabilizes. We eagerly anticipate the materialization of the new SMT partnership and the release of the new tokenomics and SmartNFT Labs scheduled for Q2 this year.

We will review the factors that contributed to the record protocol activity in December 2023 in detail next week. Don't miss that article—subscribe now!

Thank you for reading this article,

Cheers,

Kumaly.